I'm sure we can all agree that the US tax code is a disaster. With all the negative publicity the IRS generates for itself, compounded this year by confusion added by the Affordable Care Act (e.g. Obamacare penalties), it's about time to try something totally different. And I mean different in a very good way.

What is the FairTax?

The FairTax is a national sales tax. It's initially proposed to be revenue-neutral at 23%. That's pretty big. It sounds bigger if you note that, to be comparable to quoted income tax rates, 23% is a 'tax included' rate, meaning that if you paid a total of $100 at the register, $23 was tax. Thinking about it like a state sales tax, though, the rate would be 30%: If you buy a $77 item, the tax again is $23 for a total of $100, and 23/77 is 30%. Either way, same large-sounding tax.

The FairTax isn't all that big when you consider what it does: It replaces all federal personal, gift, estate, capital gains, alternative minimum, Social Security, Medicare, self-employment, and corporate taxes. If you have a job, your paycheck increases because none of these federal taxes are taken out.

What is taxed under the FairTax? Generally, consumption, things you buy at the retail level such as new goods and services. Essentially everything you spend money on, as a final consumer. This broadens the tax base, which is a good thing. Also a good thing is that the FairTax applies to everyone, period. If you buy something, you pay FairTax. Visiting from out of the country? You pay. Refuse to file federal taxes? You pay too. If you're within the borders of our good land, you pay when you purchase things. The rich and the poor, all ages, all ethnic groups, there are no special cut-outs based on lobbying. More people pay on more types of things.

The "prebate"

If the FairTax proposal were just a big sales tax, it would unduly hurt the poor. Sales taxes are spoken of as being regressive because the weight of them falls hardest on the poor. As a society, we generally like taxes to be progressive, that is, to fall more heavily on the rich. With the idea of the shifting the FairTax toward being progressive while treating all equally, the designers came up with the idea of the prebate, a "pre-rebate." The prebate would be:

- money sent monthly to every citizen, by household

- equal to the FairTax a household would pay at the official poverty level

But every household would receive the prebate. Households below the poverty line would have a negative tax rate -- the prebate would be larger than the tax they pay. Exactly at the poverty line, like the example, a household would have a zero tax rate. Above the poverty line, your effective tax rate would gradually increase and approach 23%. Extending the example, a table illustrating the effect on average tax rate is below (from Wikipedia):

| FairTax progressive rate structure Married couple: Two children | |||||

|---|---|---|---|---|---|

| Percent of poverty level | Spending | FairTax paid | Amount of rebate | Net taxes paid | Effective average tax rate |

| 25% | $6,415 | $1,475 | $5,902 | ($4,427) | |

| 50% | $12,830 | $2,951 | $5,902 | ($2,951) | |

| 100% | $25,660 | $5,902 | $5,902 | ($0) | 0.0% |

| 150% | $38,490 | $8,853 | $5,902 | $2,951 | 7.7% |

| 200% | $51,320 | $11,804 | $5,902 | $5,902 | 11.5% |

| 300% | $76,980 | $17,705 | $5,902 | $11,803 | 15.3% |

| 400% | $102,640 | $23,607 | $5,902 | $17,705 | 17.2% |

The prebate achieves the desired effect of changing the FairTax to a progressive tax, and in fact is more progressive than the current tax code.

Effects of the FairTax:

The FairTax is just at the retail level. This is important: There are no business-to-business taxes under the FairTax. This immediately makes the USA a primo place to do business. One expected effect of this is that companies re-homing their headquarters outside the USA for tax reasons will stop, and some will return.

Costs of goods at the moment include corporate taxes, the employer's contribution to employee taxes, and company departments devoted to tax compliance (or tax avoidance). These go away under the FairTax, reducing costs by 12 to possibly 25%. If the FairTax add-on is worrisome, this will substantially offset it. Because of this, some analysts say that net prices, after things settle, may be about the same with the FairTax.

Exports are not subject to FairTax since they're not sold in the USA. This makes US-made goods more attractive in the global market and levels the playing field, since our competitors with VAT taxes rebate those taxes on exports. This 18% advantage for other countries is eliminated. The FairTax would therefore improve the balance of trade and increase demand for US-made goods abroad.

The corporate profits held in overseas banks (recent estimate: $2.1 trillion) would likely be repatriated, adding to available capital in the USA. The reason for holding those profits offshore, fear of corporate taxes, vanishes with the FairTax.

What I like about the FairTax:

- The IRS would be defunded and disbanded. Woohoo!

- I like the idea of the USA becoming more attractive for business generally, and manufacturing specifically. I like the possibility of a US manufacturing renaissance.

- When you buy something, you see the taxes paid. You see what government costs out of your pocket. That's transparency. Taxes are no longer hidden.

- Tax loopholes, tax credits, special deductions, all gone. Every time I file my federal taxes, I feel like making a list of the behaviors our 'political betters' are trying to bribe us, or penalize us, into doing. Or a list of the industries' lobbying behind some blatant tax give-aways. This smacks of unfairness and has bothered me forever. The FairTax is much fairer.

- You no longer fill out a personal tax return. You no longer need to fear the IRS and their intrusive forms and audits. You regain some measure of anonymity.

- Pre-tax retirement saving is no longer restricted to a certain amount per year. All savings are pre-tax under the FairTax.

- Enforcement of the FairTax is much easier than the IRS code. It's to be done by the states, for the most part. Most states already collect sales tax, the mechanisms are in place. They'd collect the FairTax and be paid a small portion for their costs of collection.

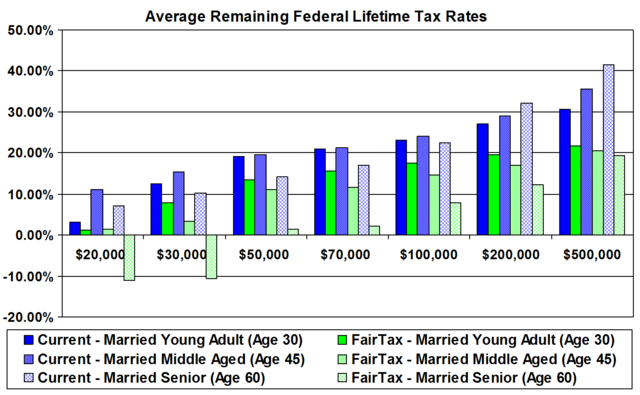

- Since more people will pay the FairTax, projections under the FairTax show the average tax burden drops at all income levels:

The poor, the rich, and the FairTax

First, what about the poor? They fare better under the FairTax for a few reasons:

- The "prebate:" As mentioned above, the poor have a net negative tax rate up to the official poverty level.

- Regressive payroll taxes dropped: The Social Security and Medicare taxes burden the working poor proportionately more than the rich, especially Social Security which cuts off above $117000 (for 2014). The FairTax includes all federal payroll taxes, so these do not affect the working poor at all, up to the poverty line.

- Jobs and wages: According to many economic studies, a consumption tax like the FairTax will increase the GDP over our current system. Business will be up. Additionally, it becomes more attractive to manufacture in the USA. Both of these effects should increase demand for labor and tighten the labor market, raising wages. Net effect: It should be easier to get and keep a decent job.

- Used goods are untaxed. Only new goods and services are taxed. People with less money or frugal natures can choose the amount of tax they pay through buying used items. (Salvation Army store, here I come!)

What about the rich? Someone will surely want to comment, "Your table doesn't show the rich. And after all, $100K incomes are practically middle-class these days. I want the wealthy to hurt. How can the FairTax hammer the really wealthy?" Indeed, the effective tax rate levels off at higher levels (at 23% of spending, of course), thus it does not 'hammer' the wealthy.

Frankly, lack of hammering doesn't bother me. But... Assuming you really want to hammer the wealthy, the FairTax comes closer than the IRS code. Let's think about this a minute: We currently tax income. Therefore the wealthy avoid income. They have capital gains, they have dividends, they have tax-free municipal bond interest, they have "deferred compensation" agreements. But the wealthy do spend and enjoy their money, however that money came to them. Let them! To the wealthy, the FairTax is not an income tax, it's a wealth tax.

The best way to start to fix "income inequality" is by improving the lot of the lower and middle classes. There's a whole lot more of them (us!) than the rich. So stop with the envy already and try to help people.

I believe that the FairTax is the best help and hope for positive change in the economy for the lower and middle classes.

Go FairTax!

It makes far too much sense, and for that reason the politicians will probably warp it all out of shape before it gets voted on. Even so, the FairTax is certainly the right direction, and I'll remain a FairTax purist. I will continue to hound my friends, relatives, and representatives about the FairTax. Pass the FairTax! It's the tax system we should have had all along.

__________________

For more information, fairtax.org has whitepapers and links of interest. The FairTax is very likely the most studied alternative tax proposal ever. If you fish around you'll find an impressive list of studies. You'll find similarly impressive lists of economists and public figures who endorse it (which I find interesting but less persuasive than the FairTax proposal itself).

I'm convinced. Go FairTax!

ReplyDelete